You’ve likely been working towards retirement for a long time and are eager to set your own schedule and enjoy the freedom to pursue your passions. Retirement is the time to enjoy reaping the rewards of your hard work, however, there are financial risks that are unique to this phase of life. Uncertainty and the need to adjust when challenges arise can be problematic for retirees but there are potential solutions to help address these risks and mitigate against their negative effects.

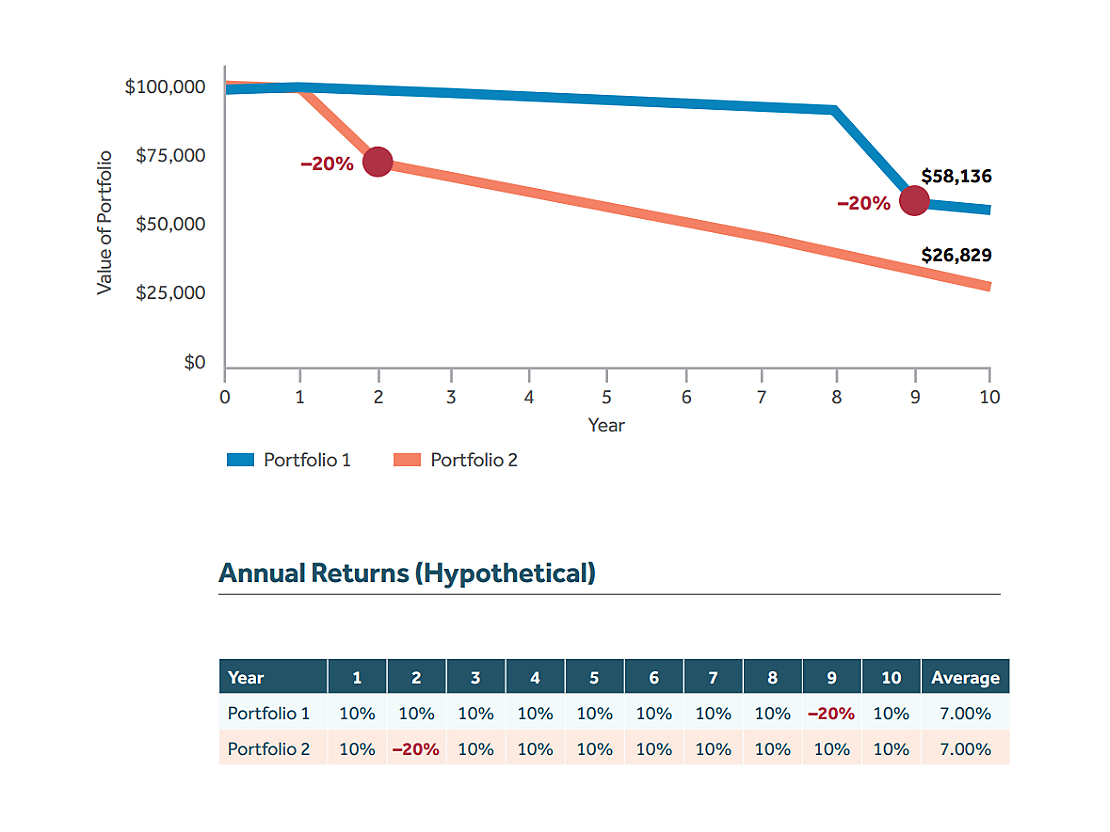

Significant losses or depletions to one’s retirement portfolio early into retirement could derail one’s plans by diminishing a retiree’s nest egg. This is known as the sequence of returns risk.

Early losses or significant withdrawals occurring early in retirement after a market downturn can have severe consequences to a retiree’s portfolio. Because any possible future gains would now accrue off a smaller base, a retiree may not have the time to benefit from a market recovery, particularly if they need to make additional withdrawals to their portfolio.

Early negative returns could affect future income:

Assumes $100,000 initial investment and $10,000 withdrawal at beginning of each year for income. This hypothetical example is for illustrative purposes only. It is not intended to predict nor guarantee any actual product results and does not reflect the effect of any applicable fees, charges, or taxes.

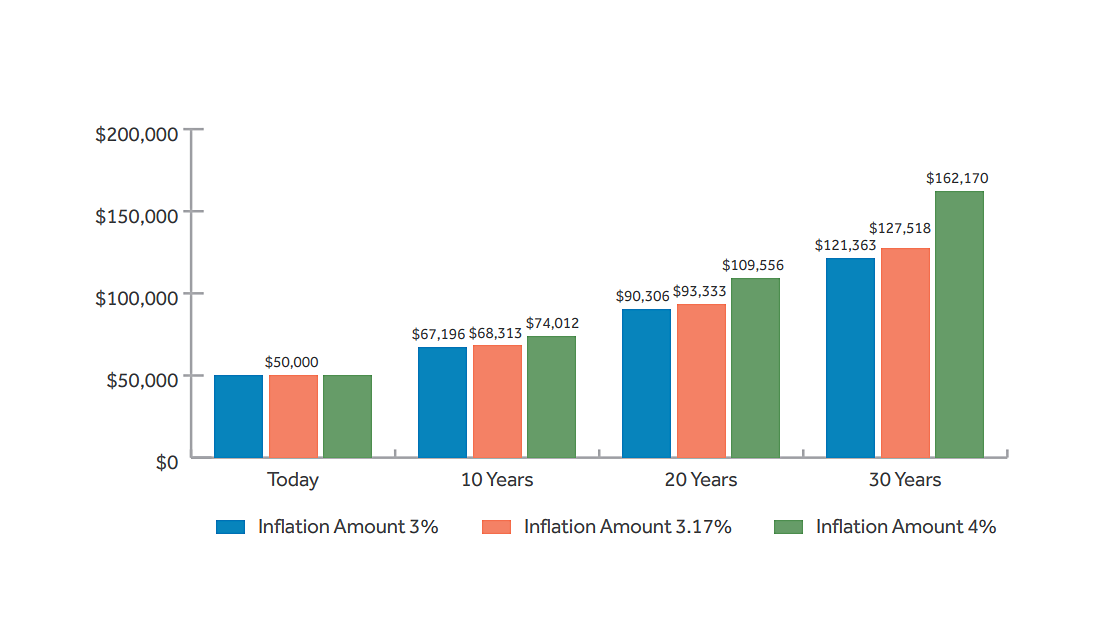

In the current inflationary environment, one’s purchasing power is reduced on vital goods and services. This can be particularly hard on those whose retirement income isn’t keeping pace with inflation. Compounding this problem, retirees experience inflation at higher rates than other consumers because so much of their expenses can involve health care.

Inflation could make future expenses rise:

The hypothetical example is for illustrative purposes only and assumes annual retirement expenses of $50,000 at the start of retirement.

1. Source: officialdata.org/us/inflation, 1914–2023.

Fear of outliving one’s assets is common for retirees. For those who will live off their accumulated savings, it can be challenging to develop a spending strategy that ensures they will have adequate means to last for 20, 30 or 40 years. Many Americans underspend their savings to ‘self-insure’ their retirement while others spend too aggressively and deplete their savings.

Probability of a healthy 65-year-old living to various ages:

This material is general in nature and is being provided for informational purposes only. It was not prepared, and is not intended, to address the needs, circumstances, and/or objectives of any specific individual or group of individuals. New York Life and its affiliates are not making a recommendation to purchase any specific products. For advice regarding your personal circumstances, you should consult with your own independent financial and tax advisors.

Source: Society of Actuaries 2012 Basic Mortality Table Life expectancy.