Our VAs

Our VAs

We understand the importance of planning for a secure and prosperous future. Our commitment to your financial well-being is reflected in the two solutions below.

Premier VA

Premier VA

Premier Variable Annuity–FP Series

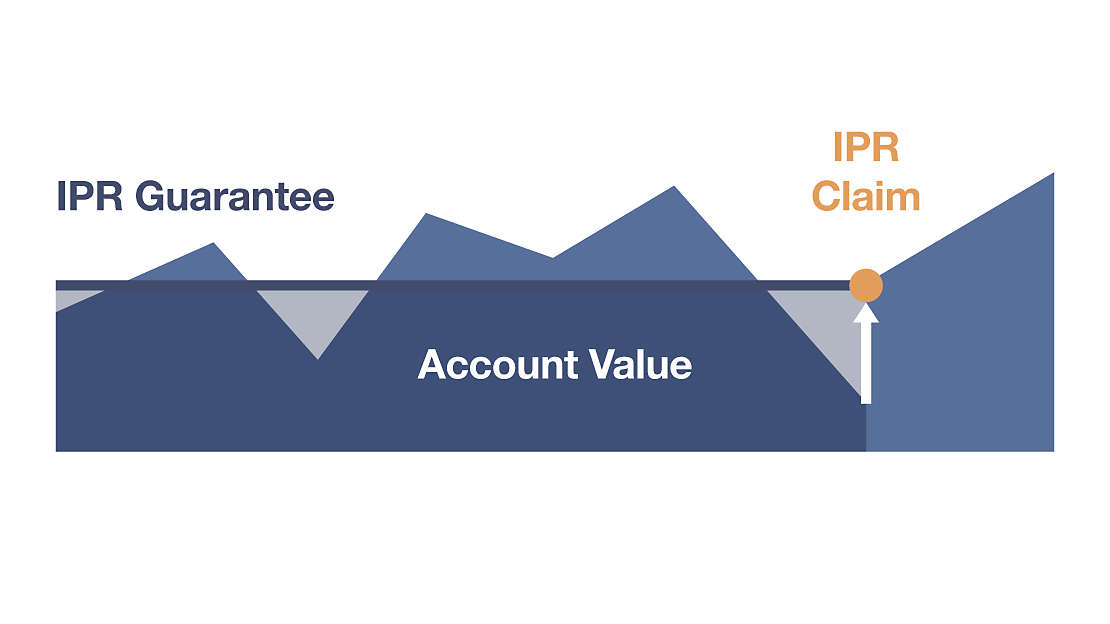

A long‐term financial product designed to help investors save for retirement. Premier offers tax deferral, a wide variety of investment options, and an optional Investment Preservation Rider–FP Series (IPR), which protects your first year premium—and additional potential growth—from down markets.

Invest with confidence when you purchase a principal guarantee.1 By protecting your initial investment from down markets, our optional Investment Preservation Rider–FP Series (IPR)* can help you worry less about market losses and invest with optimism, with up to 70% equity exposure that is not capped. In fact, our research shows that investors who purchased an IPR guarantee tend to invest more in equities than those without a guarantee.

Our research shows that IPR Investors have

15% higher equity allocations

than those without a principal guarantee.2

* The IPR does not protect the account value from day-to-day market fluctuations or against losses that could be realized prior to the completion of the holding period. That means the rider will not provide a benefit if the policy is not held for the entire holding period after it is elected or reset. Withdrawals reduce the IPR guaranteed amounts proportionally, which may be more than the actual dollar amount withdrawn; so the rider is not intended for clients who anticipate taking substantial withdrawals (including IRS Required Minimum Distributions) prior to the completion of the IPR holding period. The maximum target allocation to equity is 70% so investors may not achieve the full risk or return potential of the market.

1. Guarantees are dependent on the claims-paying ability of New York Life Insurance and Annuity Corporation (NYLIAC), so it is important to know that New York Life and NYLIAC have the highest ratings for financial strength currently awarded to any U.S. life insurer by all four major ratings agencies: AM Best (A++), Fitch (AAA), Moody’s (Aaa), and Standard & Poor’s (AA+). Source: Individual Independent rating agency commentary as of 10/19/2023.

2. Source: 2023 New York Life internal study assessing equity-holding NYL VA policyholders with and without Accumulation Benefit (AB) riders who were between the ages of 50 and 70, had an initial premium into the policy of $50,000 to $150,000, and who were issued the policy between the years of 2008 and 2011. the policies stayed active through 2020 allowing 10-year tracking.

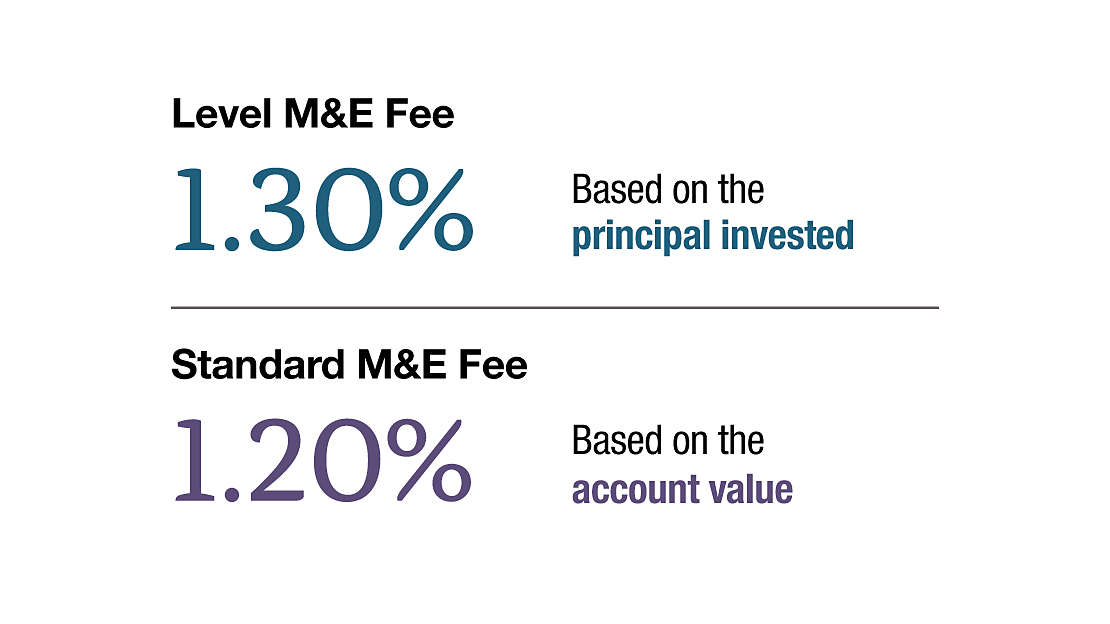

Don’t pay for growth with our exclusive, premium-based level Mortality & Expense (Level M&E) fee structure option. When investors select the Level M&E option, the product charges are based on the amount invested, not on the accumulation value of the policy. While fees from other accounts may be rising or falling with the market, charges under Premier will never go up.

Create a financial legacy with cost-effective death benefit protection, provided with every Premier policy at no additional charge. What’s more, when investors hold their policy through the initial surrender-charge period, they will be eligible for a one-time death benefit increase. For maximum legacy protection, an optional death benefit enhancement rider is also available for an additional cost.

The IPR does not protect the account value from day-to-day market fluctuations or against losses that could be realized prior to the completion of the holding period. That means the rider will not provide a benefit if the policy is not held for the entire holding period after it is elected or reset. Withdrawals reduce the IPR guaranteed amounts proportionally, which may be more than the actual dollar amount withdrawn; so the rider is not intended for clients who anticipate taking substantial withdrawals (including IRS Required Minimum Distributions) prior to the completion of the IPR holding period. The maximum target allocation to equity is 70% so investors may not achieve the full risk or return potential of the market.

IndexFlex VA

IndexFlex VA

IndexFlex Variable Annuity–FP Series

A single premium, deferred variable annuity offering market exposure, a Fixed Account, and an Index-linked Account. Offering opportunities for growth potential and principal protection, IndexFlex combines the predictability of index-linked and fixed accounts with the investment flexibility of a variable annuity.

Investors can divide their money between strategies:

- Limited Upside with Principal Protection – 0% to 100% can be allocated to an index-linked strategy or a fixed account with a no-loss guarantee.

- Unlimited Upside Potential – 0% to 100% can be allocated to variable

investment options for additional upside with the potential for loss. - Pivot as Needed – Because investors can transfer between variable, Index-linked and Fixed Account investment options within a single product, they can reallocate without triggering a tax event, or requiring policy exchanges.

Transfers from the Index-linked Account to the variable subaccounts and Fixed Account can only occur at the end of each 1-year Segment of an Index-linked Strategy. Transfers to the Index-linked Account from the variable subaccounts and Fixed Account may occur up to 2 times per policy year. A transfer from the Index-linked account from multiple sources such as the variable investment options or the Fixed Account on the same date is considered a single transfer. Each transfer begins a new recurring term strategy at the cap rate or flat rate applicable to the policy at that time. No more than 20 Index-linked Segments can be open at one time.

Our open-architecture investment platform offers uncapped growth potential with variable investment options from well-known money managers covering a broad range of investment strategies—including asset allocation options and a Fixed Account.

Index-linked Account performance is based on well-known indices—The S&P 500® Price Return Index (S&P 500)3 and Russell 2000® Price Return Index (Russell 2000)4—not opaque, custom, or hybrid indices.

IndexFlex VA is one of the only annuity products to offer a “rate-for-term” design. This structure guarantees index-linked crediting rates for the entire Initial Term for amounts invested in the Index-linked Account at the time of purchase. That means you can lock in today’s rates for the term, with no unexpected renewal rate changes. Just one, guaranteed rate.

IndexFlex is designed to help investors accumulate money for retirement in variable, index linked, and fixed investment options. Rates provided on this website apply to the Index linked and Fixed Accounts. Variable investment options are available that offer greater growth potential with corresponding market risk. Refer to the IndexFlex Investing Guide for more information. Please keep in mind that the variable investment options do not offer fixed crediting rates; their returns will fluctuate.

Literature

Literature

Literature

Access all variable annuity materials in one place.

- Fact Sheet: Premier Variable Annuity

- Client Brochure: Premier Variable Annuity

- Investment Options Guide: Premier Variable Annuity

- Prospectus and Legal Documents: Premier Variable Annuity

- Performance Summary for Level M&E fee structure policies

- Performance Summary for Traditional fee structure policies

Rates

Rates

New York Life IndexFlex Variable Annuity–FP Series

CORE CAP RATE

S&P 500® Price Return Index (S&P 500)3

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

CORE CAP RATE

Russell 2000® Price Return Index (Russell 2000)4

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

CORE FLAT RATE

S&P 500® Price Return Index (S&P 500)3

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

CORE FLAT RATE

Russell 2000® Price Return Index (Russell 2000)4

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

An Opportunity for Higher Rates

If you allocate 50% or more of your initial premium to variable investment options, to the Fixed Account, or to any combination thereof, your policy will qualify for Enhanced Crediting Rates each year that the account is eligible for Initial Term index-linked credits. If, as a result of transfers or withdrawals, your policy no longer qualifies for Enhanced Crediting Rates, Core Cap and Flat Rates will be used to calculate interest credits for the remainder of the Initial Term.

ENHANCED CAP RATE

S&P 500® Price Return Index (S&P 500)3

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

ENHANCED CAP RATE

Russell 2000® Price Return Index (Russell 2000)4

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

ENHANCED FLAT RATE

S&P 500® Price Return Index (S&P 500)3

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

ENHANCED FLAT RATE

Russell 2000® Price Return Index (Russell 2000)4

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

CAP RATE

S&P 500® Price Return Index (S&P 500)3

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

CAP RATE

Russell 2000® Price Return Index (Russell 2000)4

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

FLAT RATE

S&P 500® Price Return Index (S&P 500)3

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

FLAT RATE

Russell 2000® Price Return Index (Russell 2000)4

Premium Payment |

5 Year |

6 Year |

7 Year |

|---|

FIXED ACCOUNT

The Fixed Account (available where approved) is credited with a fixed interest rate. All guarantees, including the guaranteed minimum interest rate, are backed by the issuer, New York Life Insurance and Annuity Corporation (NYLIAC).

Surrender Charge Period |

5 Years |

6 Years |

7 Years |

|---|

Rates are as of {date} and are subject to change.

3. The S&P 500® Index includes 500 large cap stocks from leading companies in leading industries of the U.S. economy, capturing approximately 80% coverage of U.S. equities. The S&P 500® Index does not include dividends declared by any of the companies in this Index. S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). The foregoing trademarks have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by New York Life. The S&P 500® index is a product of S&P Dow Jones Indices LLC and has been licensed for use by New York Life. New York Life IndexFlex Variable Annuity–FP Series is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P or their respective affiliates and neither S&P Dow Jones Indices LLC, Dow Jones, S&P nor their respective affiliates make any representation regarding the advisability of investing in such product(s).

4. The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000® is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. The Russell 2000® Index represents approximately 10% of the total market capitalization of the Russell 3000® Index. The Russell 2000® Index includes approximately 2000 of the smallest securities based on a combination of their market capitalization and current index membership. The Russell 2000® Index does not include dividends declared by any of the companies in the Index.

The New York Life IndexFlex Variable Annuity–FP Series (IndexFlex) has been developed solely by New York Life. IndexFlex is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies.

All rights in the Russell 2000® Index (the “Index”) vest in the relevant LSE Group company which owns the Index. “Russell®” is a trademark of the relevant LSE Group company and is/are used by any other LSE Group company under license.

The Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of IndexFlex. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from IndexFlex or the suitability of the Index for the purpose to which it is being put by New York Life.

Variable annuities are long-term financial products used for retirement savings. There are fees, expenses, limitations and risks associated with this policy. All guarantees, including death benefit payments, are dependent on the claims-paying ability of NYLIAC and do not apply to the investment performance or safety of the underlying variable Investment Divisions, as they are subject to market risks and will fluctuate in value. Withdrawals may be subject to ordinary income taxes and if made prior to age 59½ may be subject to a 10% IRS penalty tax. For costs and complete details, contact a financial professional.

This material is general in nature and is being provided for informational purposes only. It was not prepared, and is not intended, to address the needs, circumstances and/or objectives of any specific individual or group of individuals. New York Life and its affiliates are not making a recommendation to purchase any specific products. For advice regarding your personal circumstances, you should consult with your own independent financial and tax advisors.

This flyer is not a complete description of the New York Life IndexFlex Variable Annuity–FP Series product and is authorized for use by the general public only if preceded or accompanied by the product and funds prospectuses. Investors are asked to consider the investment objectives, risks, charges, and expenses of the investment carefully before investing. The prospectuses contain this and other information about the product and underlying investment options. Please read the prospectuses carefully before investing.

Products and features are available where approved. In most jurisdictions, the policy form numbers are as follows (state variations may apply): New York Life IndexFlex Variable Annuity–FP Series (ICC20V-P02 or it may be NC20V-P02).

Please refer to the product prospectus for more information. New York Life Variable Annuities are issued by New York Life Insurance and Annuity Corporation (“NYLIAC”), a Delaware Corporation. NYLIFE Distributors LLC, Member FINRA/SIPC, is the wholesale distributor and underwriter for these products. Both NYLIAC and NYLIFE Distributors LLC are wholly owned subsidiaries of New York Life Insurance Company, 51 Madison Avenue, New York, NY 10010. Variable annuities offered through properly licensed registered representatives of a third party registered broker dealer.

New York Life Premier Variable Annuity–FP Series

FIXED ACCOUNT

Effective Date |

Fee Structure |

Base Rate |

|---|

DOLLAR-COST AVERAGING (DCA) ADVANTAGE PLAN RATES2

Duration |

Fee Structure |

Rate |

|---|

DOLLAR-COST AVERAGING (DCA) ADVANTAGE EFFECTIVE YIELD2

Duration |

Fee Structure |

Rate |

|---|

Rates are as of {date} and are subject to change.

2. Available in states where approved. Only new premium payments may be allocated to the DCA Advantage Account/Plan. Money may not be transferred into the DCA Advantage Account/Plan from any of the Investment Divisions or the Fixed Accounts. Money in the DCA Advantage Account/Plan only earn the DCA Advantage Account/Plan interest rates while it is in the account waiting to be transferred into the Investment Divisions. Because the money is periodically transferred out of the DCA Advantage Account/Plan, amounts in the DCA Advantage Account/Plan will not achieve the declared annual effective rate. Once money has been transferred to the Investment Divisions, it is subject to market risks and will fluctuate in value. A program of dollar-cost averaging does not guarantee a profit or protect against losses in declining markets. Investors must consider their financial ability to continue investing systematically during periods of declining unit values.

The DCA rate will be higher than "Actual Yield," which is the amount an investor may expect to earn on a $100,000 premium over the course of the 6-month DCA program. The DCA rate applies only to the amount in the account, excluding the funds moved into equities.

Issued by: New York Life Insurance and Annuity Corporation (A Delaware Corporation)

Distributed by: NYLIFE Distributors LLC. (Member FINRA), 51 Madison Avenue, New York, NY 1001