- Update your address, contact details and beneficiaries.

- Make automatic payments.

- Go green and reduce clutter by having documents delivered electronically.

- Check the value of your policies and investments.

- Download statements and tax documents.

I'd like to take some money from my annuity. Can I do this online?

If you are the sole owner of your policy, have granted transaction authority for your agent or have added a third party with transaction authority, a partial disbursement may be made on your policy via this website.

NOTE: no transactions are allowed on policies that are Jointly Owned. Requests for joinly owned policies must be submitted in writing and signed by all owners.

Follow step-by-step instructions to guide you through this simple process.

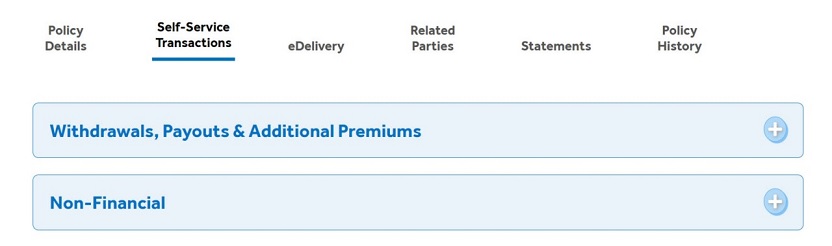

Step 1. Log into your account and select your policy.

Step 2. In the Self-Service Transactions tab, click on Withdrawals, Payouts & Additional Premiums.

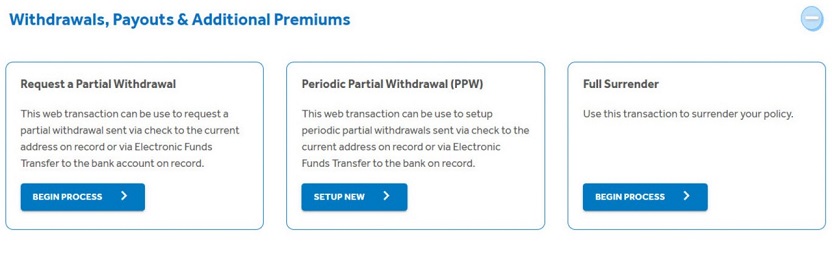

Step 3. Locate the box titled, “Request a Partial Withdrawal” as pictured below.

Then follow these next steps:

3a. Click on BEGIN PROCESS.

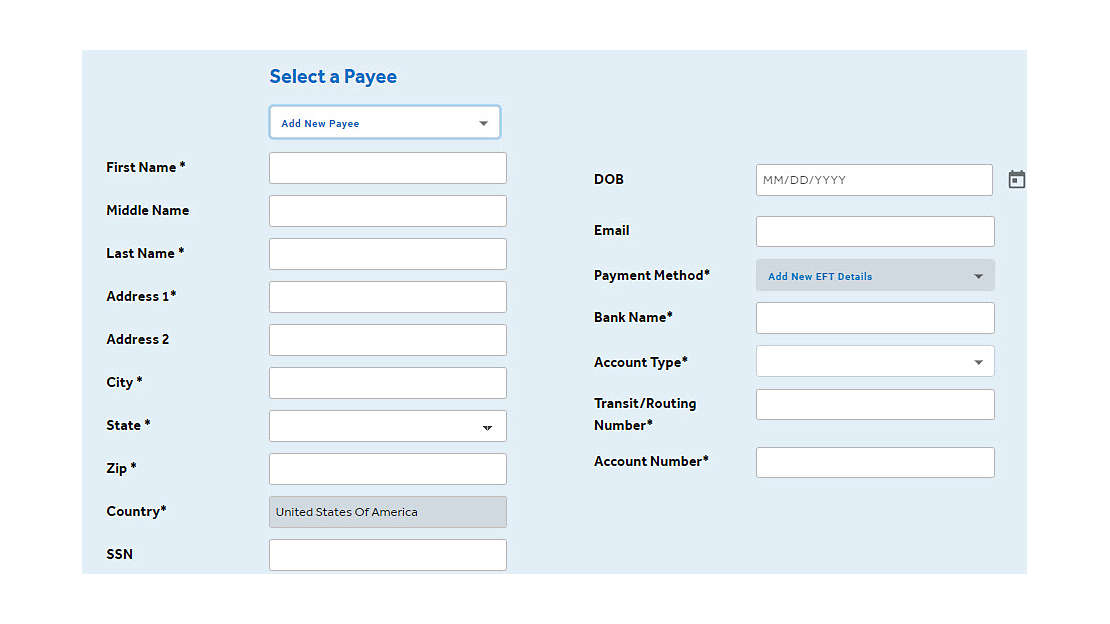

3b. Now go to “A. Payee Selection”

- Click the ↓ arrow in the “Add New Payee” box and select desired payee. This is where you can add a bank account to have funds directly deposited into your savings or checking account.

- NOTE: You must be listed as an owner of the savings or checking account.

3(c). Once you’ve entered all information, click the SAVE button.

Step 4: You can now see what you have so far by reviewing “1. Partial Withdrawal Details”.

4(a). If you’d like to make any changes to the payee, click the BACK TO PAYEE button:

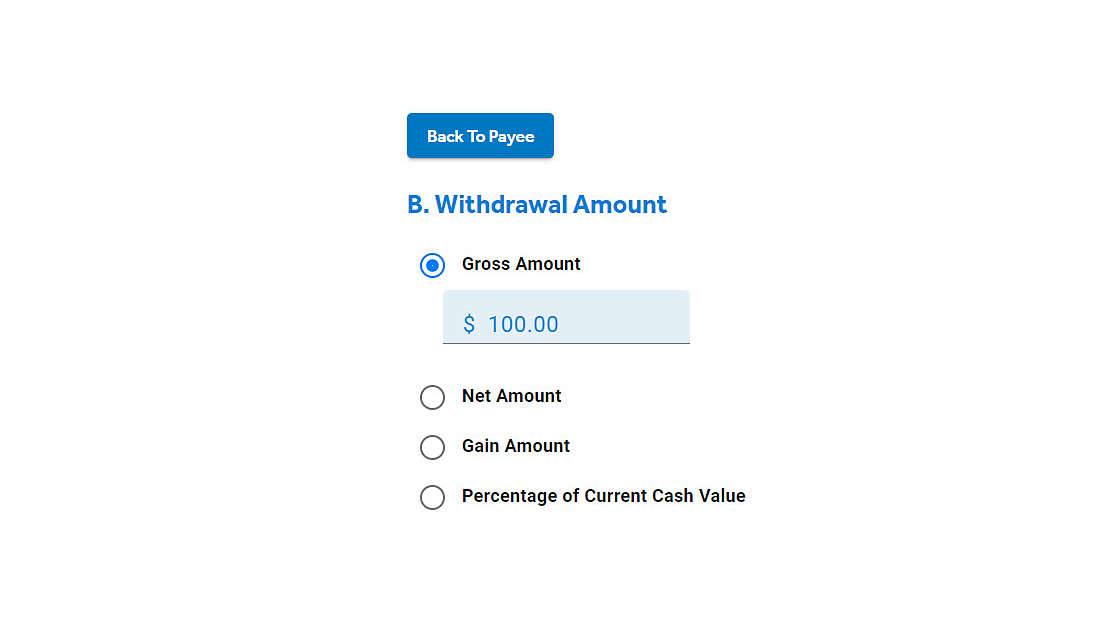

Step 5 .Once you are satisfied with the payee, go to Section “B. Withdrawal Amount”, select a payment option and withdrawal amount:

**IMPORTANT: The maximum online withdrawal amount is $250,000.00 and you must maintain a balance of $2,000.00 per the annuity contract.If you wish to request a Full Surrender or withdraw $250,000.00 gross or more, please submit a completed Withdrawal Form.

- GROSS: Any surrender charges (if applicable) and tax withholding will be deducted from the payment you receive.

- NET: The payment you will receive will be equal to the amount requested. Any surrender charges (if applicable) and tax withholding will be deducted from your annuity balance.

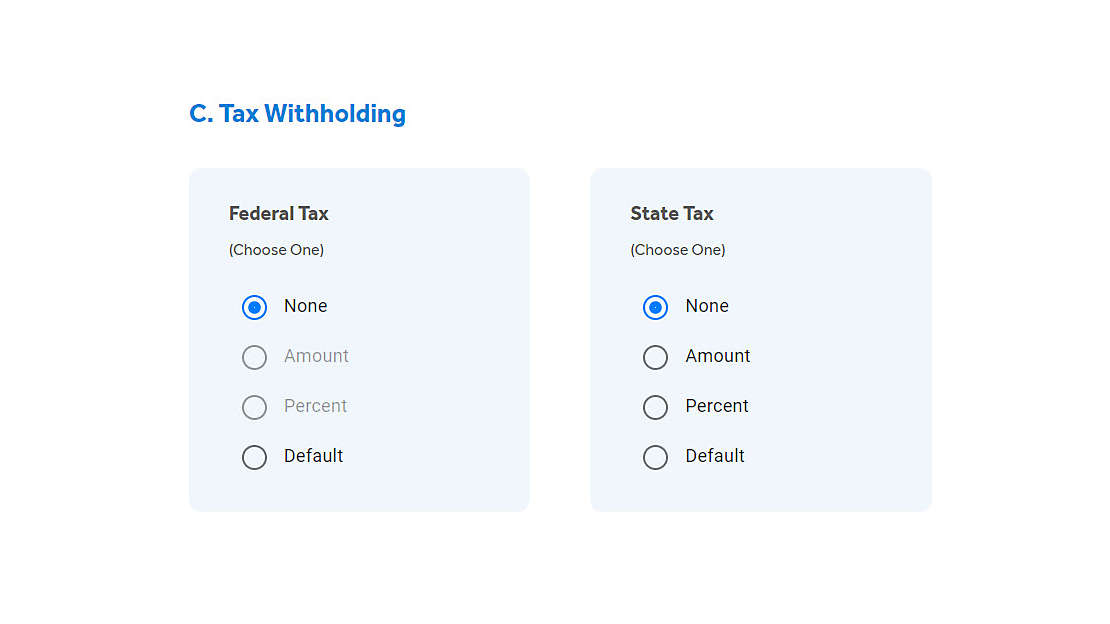

Step 6 (a). Now go to Section “C. Tax Withholding”. Select desired “Federal Tax” and “State Tax” withholding (see pictured example below):

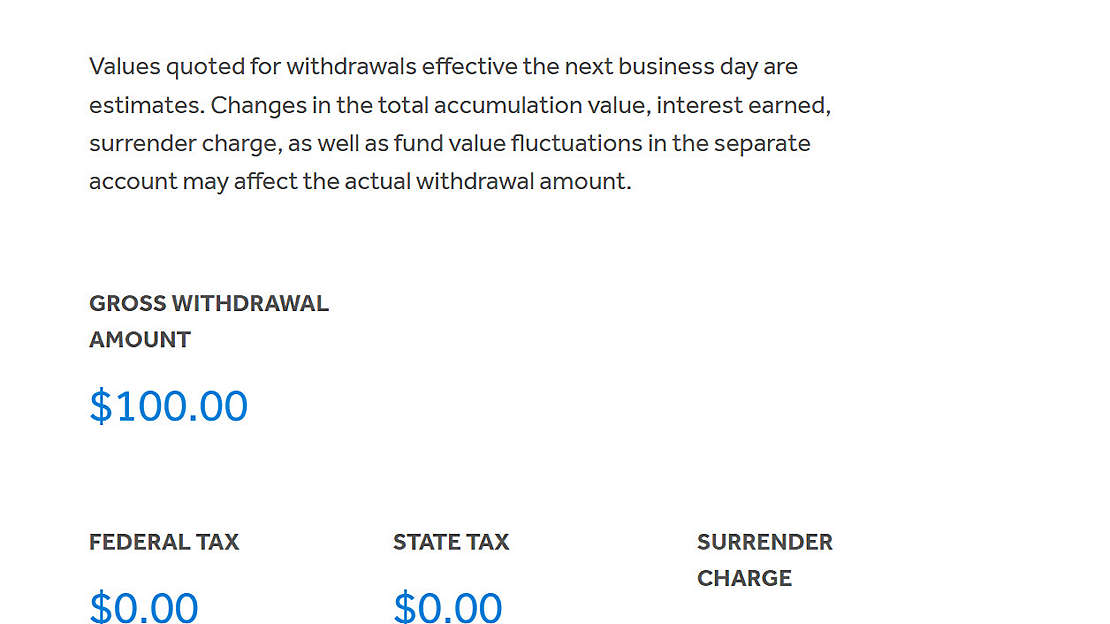

Step 6 (b). Now click the PREVIEW WHAT YOU’LL SUMBIT button to review what you have so far:

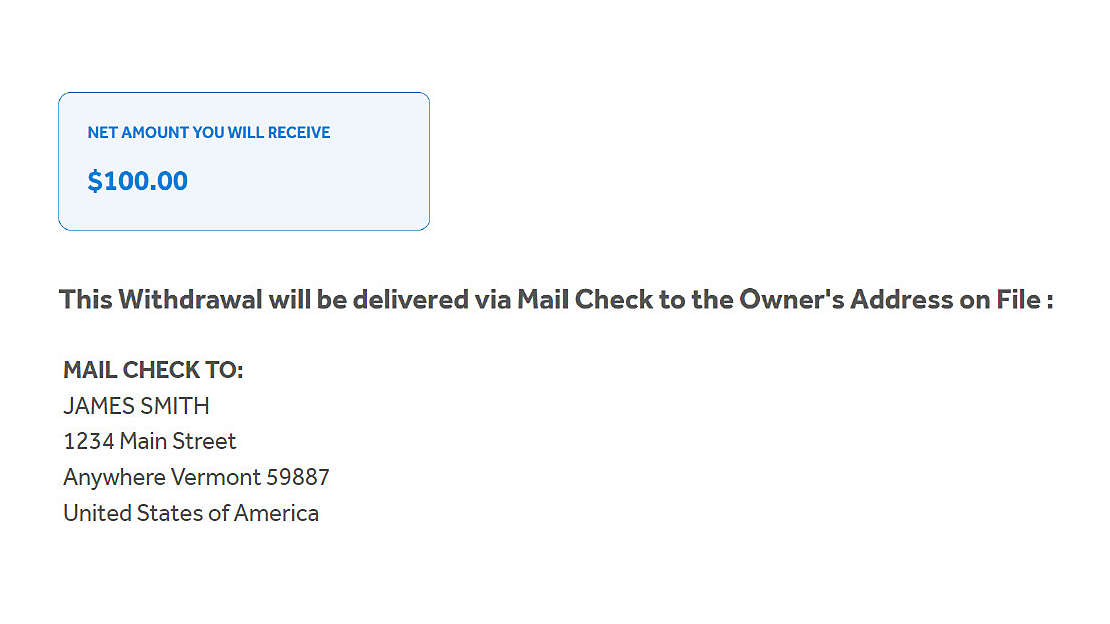

Step 7. You will see a summary of what you have submitted at this point:

Step 8. If everything is correct, click NEXT. If changes are needed to your request – click MODIFY:

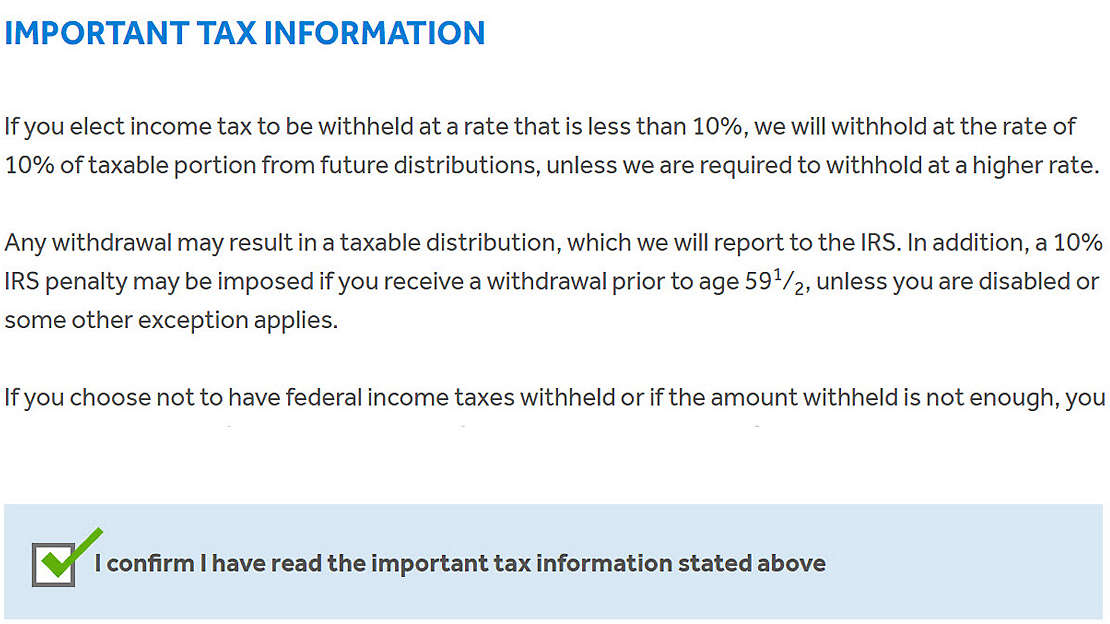

Step 9. Next, see “IMPORTANT TAX INFORMATION” as pictured:

Please read and confirm that you have read the important tax information. You can still modify your request at this time by selecting MODIFY to make changes, or you can SUBMIT THIS TRANSACTION to process your request.

Step 10. That's it! Now you're set to receive your funds.

When will I receive my funds?

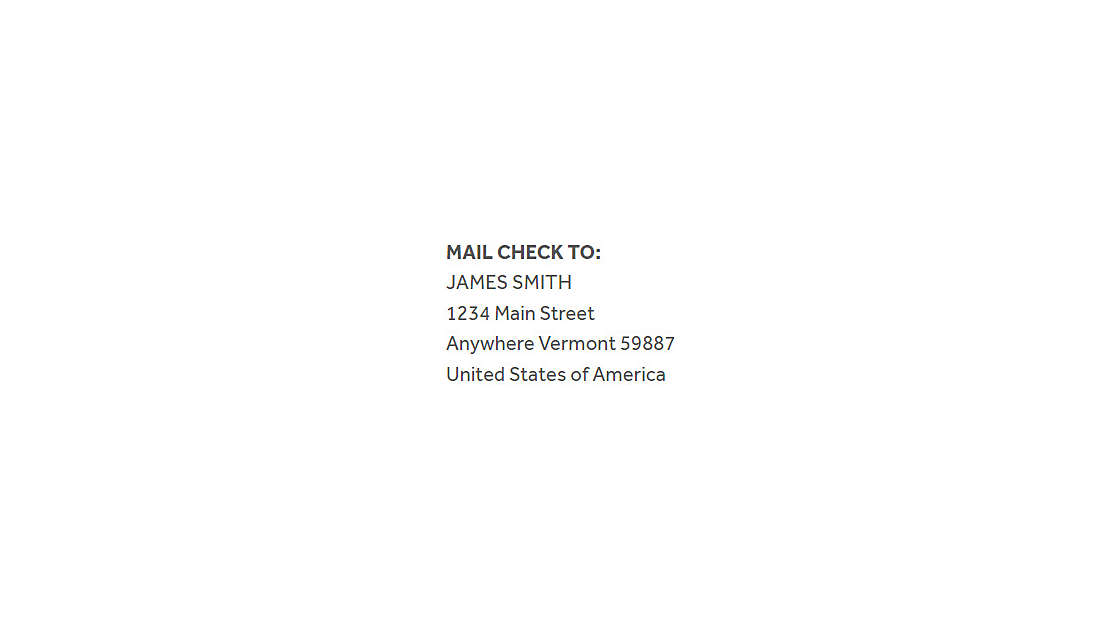

- Check by Mail: The funds will be mailed the next business day and you will receive the check depending on the standard mail delivery times in your area (generally 3-5 business days).

- Direct Deposit / EFT: The funds will be released the next business day and will be available in your account based on your financial institution’s processing times (generally 24-48 hours).

Not Registered Yet?

Registering for an online account is simple, saves time, and provides access to all of your account information in one place.

If you have questions about creating an account, please contact our Service Center by calling 800-762-6212, Monday through Friday, 8:30am to 5:30pm ET.