Withdrawal Riders Guide

This guide can assist you in learning about withdrawal riders for New York Life Income and Fixed Deferred Annuities.

New York Life (NYL) Guaranteed Lifetime Income Annuities, Guaranteed Future Income Annuities and Guaranteed Period Income Annuities all may offer withdrawal riders at issue.

The purpose of these riders is to allow a certain amount of liquidity (access to cash) in addition to the payout terms of the contract. Payment accelerations allow a client to receive a certain number of payments as an immediate lump sum payout and resume normal payouts once the acceleration period has elapsed. Withdrawals allow a client to receive a percentage of the discounted value of remaining guaranteed payments as an immediate lump sum payout, but can impact the payments that resume after the end of the guaranteed payment period.

The following describes the payment options which may be available to a contract owner.

Guaranteed Lifetime Income Annuity (GLIA)

What is it?

Just like it sounds, this is an acceleration of payments: the client receives the next five months of payments as an immediate payout in addition to their next income payment, as a lump sum payout.

This means the clients will not receive their scheduled payments for the next five months— they already received them! Payments will commence as usual once the 6-month payment period is elapsed.

Are there any restrictions to exercising this withdrawal option?

- Valid for Non-Qualified polices only

- This option may be used TWICE during the lifetime of the policy.

Is a form required?

Yes, the 6-month payment acceleration should be requested on the Withdrawal or Payment Acceleration Request Form for the Guaranteed Lifetime Income Annuity. The withdrawal forms carry an important Federal Income Tax disclosure notifying the owner that withdrawals and/or accelerations of payments will be reported to the IRS as fully taxable regardless of fund type. NYL requires the owner confirm understanding of this disclosure and are advised to consult their tax advisor prior to making a cash withdrawal or accelerating their payments.

What is it?

The key to understanding is that this withdrawal is an UP TO 100% withdrawal option, which means that the policy owner may withdraw up to 100% of the discounted value of remaining guaranteed payments at any time. Future income payments through the end of the guaranteed payment period will be reduced by the withdrawal percentage, and full payments will resume after the end of the guaranteed payment period (if annuitant is living).

Are there any restrictions to exercising this withdrawal option?

- Valid for Non-Qualified or ROTH IRA polices only

- Policy owner must be age 59½ or older

- May be exercised ONCE during the life of the policy.

- Available only to these policy payment options:

- Life with Cash Refund

- Life with Installment Refund

- Life with 5 to 30 Years Period Certain

Is a form required?

Yes, to process a 100% withdrawal request, the request should be submitted on the Withdrawal or Payment Acceleration Request Form for the Guaranteed Lifetime Income Annuity which must be signed and dated by the client. The withdrawal forms carry an important Federal Income Tax disclosure notifying the owner that withdrawals and/or accelerations of payments will be reported to the IRS as fully taxable regardless of fund type. NYL requires the owner confirm understanding of this disclosure and are advised to consult their tax advisor prior to making a cash withdrawal or accelerating their payments.

The TPD Service Center must first process a quote in order to process any withdrawal request. Quotes may be requested via the Service Center at 1-800-762-6212, Monday through Friday.

Note: the quotes may be requested via the Service Center, but representatives CANNOT review with client, as the quotes need to be accompanied by certain disclosures. Withdrawals are processed upon receipt of the request and the quote here at NYLife.

What is it?

It is important to understand that this is a 30% withdrawal of the discounted value of the remaining expected payments, based on the annuitant’s life expectancy when the policy was issued. This will reduce all future guaranteed payments by 30% for the life of the policy.

Important to tote: This option may be exercised on the 5th, 10th, or the 15th anniversary of the first income payment, or upon proof of a significant non-medical financial loss, as specified in the client’s policy.

Are there any restrictions to exercising this withdrawal option?

- Policy owner must be age 59½ or older

- May be exercised ONCE during the life of the policy

- Non-medical financial loss not available in California, Connecticut, Florida and New York

Tax classification of policies dictates payment options available:

- Valid for Non-Qualified polices with the following payment options:

- Life Only

–– or ––

- Life with 25% or 50% Percent of Premium Death Benefit

- Valid for Qualified polices with the following payment options:

- Life Only

- Life with Cash Refund

- Life with Installment Refund

- Life with 5 to 30-Years Certain

- Valid for ROTH IRA Life Only policies

Is a form required?

Yes, to process a 30% cash withdrawal request, the request should be submitted on the Withdrawal or Payment Acceleration Request Form for the Guaranteed Lifetime Income Annuity which must be signed and dated by the client. The withdrawal forms carry an important Federal Income Tax disclosure notifying the owner that withdrawals and/or accelerations of payments will be reported to the IRS as fully taxable regardless of fund type. NYL requires the owner confirm understanding of this disclosure and are advised to consult their tax advisor prior to making a cash withdrawal or accelerating their payments.

The TPD Service Center must first process a quote in order to process any withdrawal request. Quotes may be requested via the Service Center at 800-762-6212, Monday through Friday.

Note: the quotes may be requested via the Service Center, but representatives CANNOT review with client, as the quotes need to be accompanied by certain disclosures. Withdrawals are processed upon receipt of the request and the quote here at New York Life.

.

Guaranteed Future Income Annuity (GFIA)

What is it?

Just like it sounds, this is an acceleration of payments: the client receives the next five months of payments as an immediate payout in addition to their next income payment, as a lump sum payout.

This means the clients will not receive their scheduled payments for the next five months – they already received them! Payments will commence as usual once the 6-month payment period is elapsed.

Are there any restrictions to exercising this withdrawal option?

- May be used twice during the lifetime of the policy

- Not available with a QLAC

Is a form required?

Yes, the 6-month payment acceleration should be requested on the Withdrawal or Payment Acceleration Request Form for the Guaranteed Lifetime Income Annuity.

Guaranteed Period Income

What is it?

The key to understanding is that this withdrawal is an UP TO 100% withdrawal option, which means that the policy owner may withdraw up to 100% of the discounted value of remaining guaranteed payments at any time. Future income payments through the end of the guaranteed payment period will be reduced by the withdrawal percentage, and full payments will resume after the end of the guaranteed payment period (if annuitant is living).

Are there any restrictions to exercising this withdrawal option?

- Valid for Non-Qualified and Qualified policies

- Policy owner must be age 59½ or older

- May be exercised ONCE during the life of the policy

Is a form required?

Yes, you do. To process a 100% withdrawal request, the request should be submitted on the Withdrawal or Payment Acceleration Request Form for the Guaranteed Period Income Annuity which must be signed and dated by the client. The withdrawal forms carry an important Federal Income Tax disclosure notifying the owner that withdrawals and/or accelerations of payments will be reported to the IRS as fully taxable regardless of fund type. NYL requires the owner confirm understanding of this disclosure and are advised to consult their tax advisor prior to making a cash withdrawal or accelerating their payments.

The TPD Service Center must first process a quote in order to process any withdrawal request. Quotes may be requested via the Service Center at 1-800-762-6212, Monday through Friday.

Note: the quotes may be requested via the Service Center, but representatives CANNOT review with client, as the quotes need to be accompanied by certain disclosures. Withdrawals are processed upon receipt of the request and the quote here at NYLife.

What is it?

Just like it sounds, it is an acceleration of payments: the client is receiving all the payments promised, as a lump sum payout. The client receives the next two months of payments as an immediate payout in addition to their next income payment.

This means they will not receive their payment – they already took them. Payments will commence as usual once the 3-month payment period is elapsed.

Just like it sounds, this is an acceleration of payments: the client receives the next two months of payments as an immediate payout in addition to their next income payment, as a lump sum payout.

This means the clients will not receive their scheduled payments for the next two months— they already received them! Payments will commence as usual once the 3- month payment period is elapsed

Are there any restrictions to exercising this withdrawal option?

- May be used once during the lifetime of the policy

Is a form required?

Yes, the 3-month payment acceleration should be requested on the Withdrawal or Payment Acceleration Request Form for the Guaranteed Period Income Annuity which must be signed and dated by the client. The withdrawal forms carry an important Federal Income Tax disclosure notifying the owner that withdrawals and/or accelerations of payments will be reported to the IRS as fully taxable regardless of fund type. NYL requires the owner confirm understanding of this disclosure and are advised to consult their tax advisor prior to making a cash withdrawal or accelerating their payments.

The TPD Service Center must first process a quote in order to process any withdrawal request. Quotes may be requested via the Service Center at 800-762-6212, Monday through Friday.

Note: the quotes may be requested via the Service Center, but representatives CANNOT review with client, as the quotes need to be accompanied by certain disclosures. Withdrawals are processed upon receipt of the request and the quote here at NYLife.

.

Annuity products are issued by New York Life Insurance and Annuity Corporation, a wholly owned subsidiary of New York Life Insurance Company, 51 Madison Avenue, New York, NY 10010. All guarantees are dependent on the claims-paying ability of New York Life Insurance and Annuity Corporation (NYLIAC). Available in jurisdictions where approved.

For most jurisdictions, the policy form number for the New York Life Guaranteed Lifetime Income Annuity is ICC-P102. It may be 211-P102, and state variations apply. For most jurisdictions, the policy form number for the New York Life Guaranteed Future Income Annuity is ICC11-P100. It may be 211-P100, and state variations apply. For most jurisdictions, the policy form number for the New York Life Guaranteed Period Income Annuity is ICC11-P112, and state variations apply.

This material is being provided for informational purposes only, and was not prepared, and is not intended, to address the needs, circumstances and objectives of any of individual or groups of individuals. New York Life, its affiliates, employees and agents are not making a recommendation that any of your particular clients purchase any specific products, and do not provide tax or legal advice.

For Financial Professional Use Only

Clear Income Fixed Deferred Annuity

Why a Clear Income FDA

The NYL Clear Income product is a Fixed Deferred Annuity (FDA), and offers both liquidity and principal protection and is issued by New York Life Insurance and Annuity Corporation. What sets the Clear Income annuity apart from our other Fixed Deferred Annuity offerings is the Guaranteed Living Benefit Rider (GLWB).

Not only will NYL guarantee the interest rate paid to the principal/accumulation, NYL will create, alongside the accumulation value, a guaranteed growth valuation which compounds at 5% every year — a growth valuation that carries with it an additional guarantee to match the accumulation value yearly if the accumulation value’s guaranteed interest outstrips the 5%—offering an absolute stable growth to the income NYL will pay when you receive your income if interest rates rise. (See Guaranteed Growth to the Income Base.)

The Clear Income FDA can offer you confidence that the growth of your client’s Accumulation Value is guaranteed: their principal is protected and not subject to market risk. Your customer’s policy, and NYL’s guarantees are backed by the strength of NYL: we assume the risk of all the guarantees we make: both your client’s earnings and the lifetime income in the GLWB.

NYL offers a Guaranteed Lifetime Benefit Rider for the NYL Clear Income FDA. Customers accumulate value in the Income Base and may begin income payments whenever they like.

Access to Cash and Surrenders:

This is a Fixed Deferred Annuity with the option of surrendering the policy at any time.

- A surrender charge period may apply, but the policy has a defined cash value and guaranteed earnings.

- Owners may take cash withdrawals from the accumulation value.

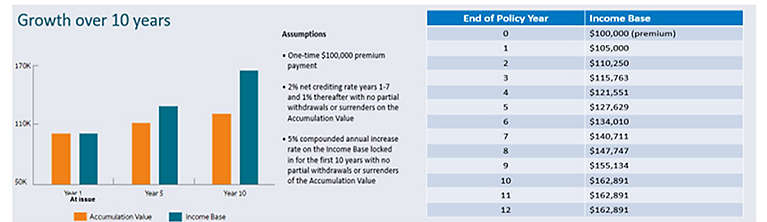

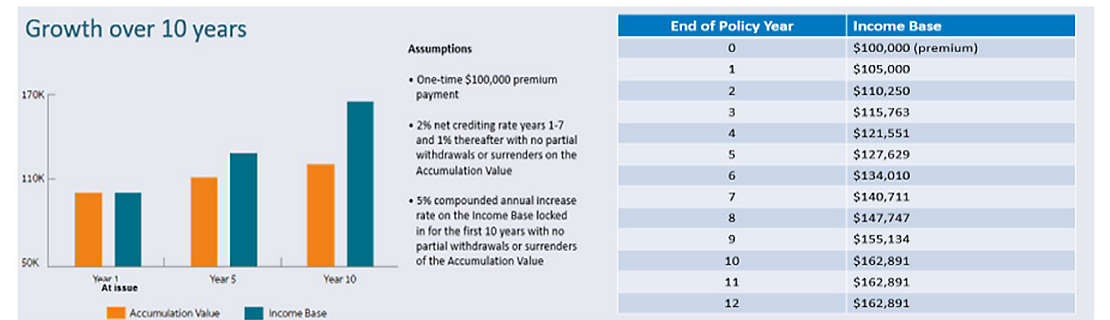

Guaranteed Growth to the Income Base

NYL guarantees the Accumulation Value’s earned interest rate, and guarantees, for up to ten years, the greater of:

- 5% Annual Increase: A 5% yearly adjustment, to the original premium compounds* annually to the Income Base, based on Policy Anniversary accumulation value. (*Based on the original premium.)

-OR-

- Step-up to the Income Base amount: NYL will match the Policy Anniversary accumulation value if the earned interest rate is above 5%.

How withdrawals will impact the growth of the Income Base

All withdrawals taken prior to or in excess of the Guaranteed Lifetime Withdrawals will result in a proportional reduction to the Income Base. What this means is that the illustrated Guaranteed Income will be lower.

The Clear Income FDA offers liquidity and flexibility. We allow access to accumulation values at all times. This gives customers the freedom to start receiving income when they want, and the option to grow their income base to the full guaranteed income amount, or enjoy the long-term benefits of taking less income now. Unlike a Guaranteed Lifetime Income Annuity, the policy has a cash accumulation value which may be surrendered.

Not all withdrawals will result in surrender charges or MVA adjustments. MVA and surrender-charge free withdrawals include the greatest of:

- Annual GLWB amount (once lifetime withdrawals have commenced.) This amount is recalculated every policy year

- 10% of the Accumulation Value as of the previous policy anniversary

- 10% of the current Accumulation Value

- 100% of the gain earned in the policy (for policies with a premium amount of $100,000 or more)

- Annual required minimum distribution (RMD) amount

A customer may access cash via:

Early Access Withdrawals

NYL will allow a customer a single, one-time withdrawal of cash that will neither cap the age-based Withdrawal Rate, nor end the growth of the Income Base via the Annual Increase or Step-Up adjustments.

- The Income Base will be reduced proportionally but will continue to receive the greater of the Annual Increase/Step-Up.

Example – Early Access Withdrawal:

The customer purchased their policy with a $100,000 premium and are receiving a Guaranteed Interest Rate of 2%. No withdrawals were made in the first Policy Year. Hence, at the end of the first policy year, the accumulation value would be $102,000.00.

However, the Income Base, growing at 5%, will be $105,000.00.

The next year, the customer decides to take a withdrawal. The customer would be allowed up to 10% of the Anniversary Value surrender-charge free, or, in this case, $10,200.00. The customer decides to withdrawal $2,500.00 from the account, a 2.5% withdrawal. When funds are withdrawn, the Accumulation value will be reduced by the $2,500, and the Income Base will be reduced by the same proportionate amount (2.5%), or $2,625.

Note: The Accumulation Value will, of course, be credited with the 2% interest (guaranteed) and the Income Base will then continue to grow at the 5% compounded annual increase rate.

With no further withdrawals, the client will benefit from continued growth in their Income Base.

Lifetime withdrawals (GLWB withdrawals)

All future withdrawals will be considered GLWB withdrawals. Only when the customer commences the GLWB withdrawals, will the Income Base growth end and the customer’s age-based Withdrawal Rate be capped.

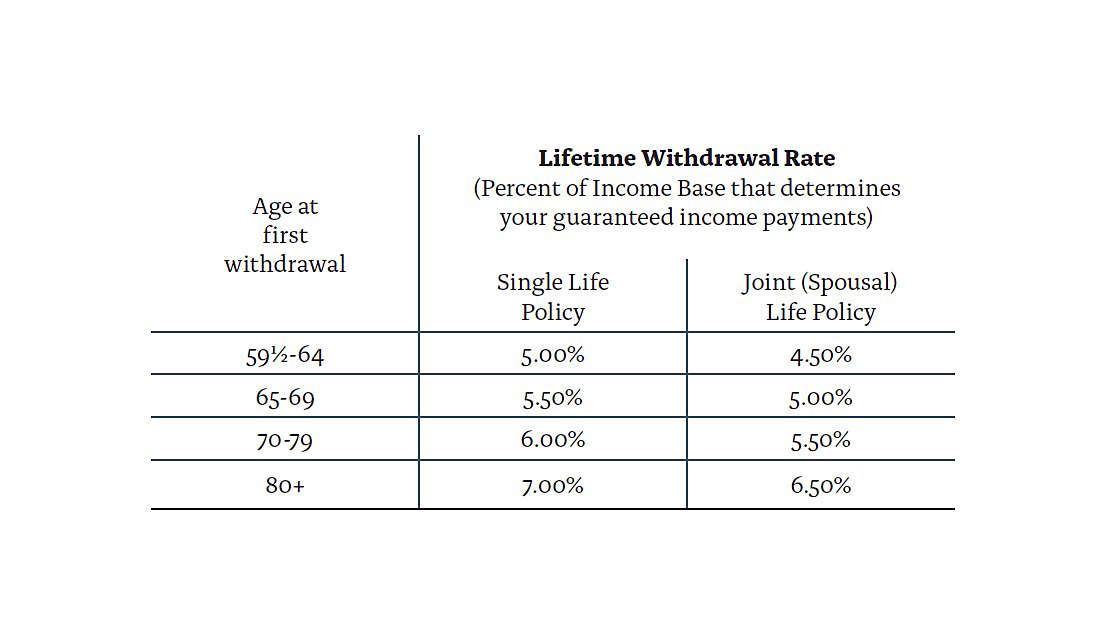

Yearly GLWB Income Amounts are computed every Policy Year as follows:

- The withdrawal amount is determined by multiplying the withdrawal rate (listed below) by the value of the Income Base.

- The withdrawal rate locks in at the time of client’s first lifetime withdrawal and is based on their age and whether the client elects a single or joint (spousal) life policy.

(For joint life policies, the withdrawal rate is based on the younger annuitant)

- Once GLWB Withdrawals begin, income payments are guaranteed for life.

GLWB Excess Lifetime Withdrawals

Customers may take more than the annually computed GLWB amount. Amounts in excess of the computed GLWB amount will reduce the Income Base proportionally for the next year.

Income Base Credits

Alternatively, a customer is not required to take the full GLWB amount in any year. Amounts not taken will be credited to the Income Base as an Income Base Credit. The Income Base Credit is based on the portion of the annual GLWB amount not withdrawn between policy anniversaries. The difference between the amount withdrawn and the annual GLWB amount is multiplied by a factor (i.e. [50%]) to determine the Income Base Credit for that year.

Full policy surrender

The customer may surrender their policy at any time.

Death Benefits

Upon the death of the owner, a Clear Income Policy will provide a Death Benefit to beneficiaries of the remaining accumulation value in the policy.

- NYL allows joint spousal annuitants in order to calculate the income stream when the GLWB Rider income commences.

- Income will be calculated based to the joint lifespans, and will continue until both annuitants are deceased

For Agent use only.

To learn more about New York Life's Clear Income Fixed Deferred Annuity, visit the Clear Income Glossary.

Log in or register to view client accounts.

Annuity Business Processing Guide for Advisors

The goal of this guide is to help you understand the New York Life annuity process and provide tools and resources to support your success.

Build a Generation-Resilient Business

The greatest transfer of wealth in history has begun as financial advisors face the challenge of a shrinking book of business.

Our Annuities

Our suite of solutions helps prepare for retirement with confidence and peace of mind.